Book Publishing and the Future of Subscriptions 📚

Welcome! This is the first post of a newsletter on media, tech and startups, with a focus on the European ecosystem. To receive this newsletter on your inbox, subscribe here:

Earlier this year in March, back when the COVID-19 pandemic seemed no more disruptive than the 2002-2004 SARS outbreak, I wrote an article on the growth of unlimited subscription models for ebooks and audiobooks, arguing that, rather than shunning them, big publishers should actively engage with them. Not just to diversify their channel and client base, which is of particular importance in a market dominated by Amazon, a tech giant not exactly new to digital subscription services itself; but because people are getting more and more accustomed to consuming content, from newsletters to games, via subscriptions.

A variety of ebook and audiobook subscription services is available in Europe, from France to Sweden, home to the most popular of such services: Storytel. Through several key home and international acquisitions, Storytel has become a main player not just within the fast-growing audio space – Storytel was initially born as an audiobook-only service - but within the wider publishing industry. Along with Storytel, other prime ebook and audiobook streaming platforms include BookBeat, Nextory, Scribd, etc.

Assessing the Opportunity 🔎

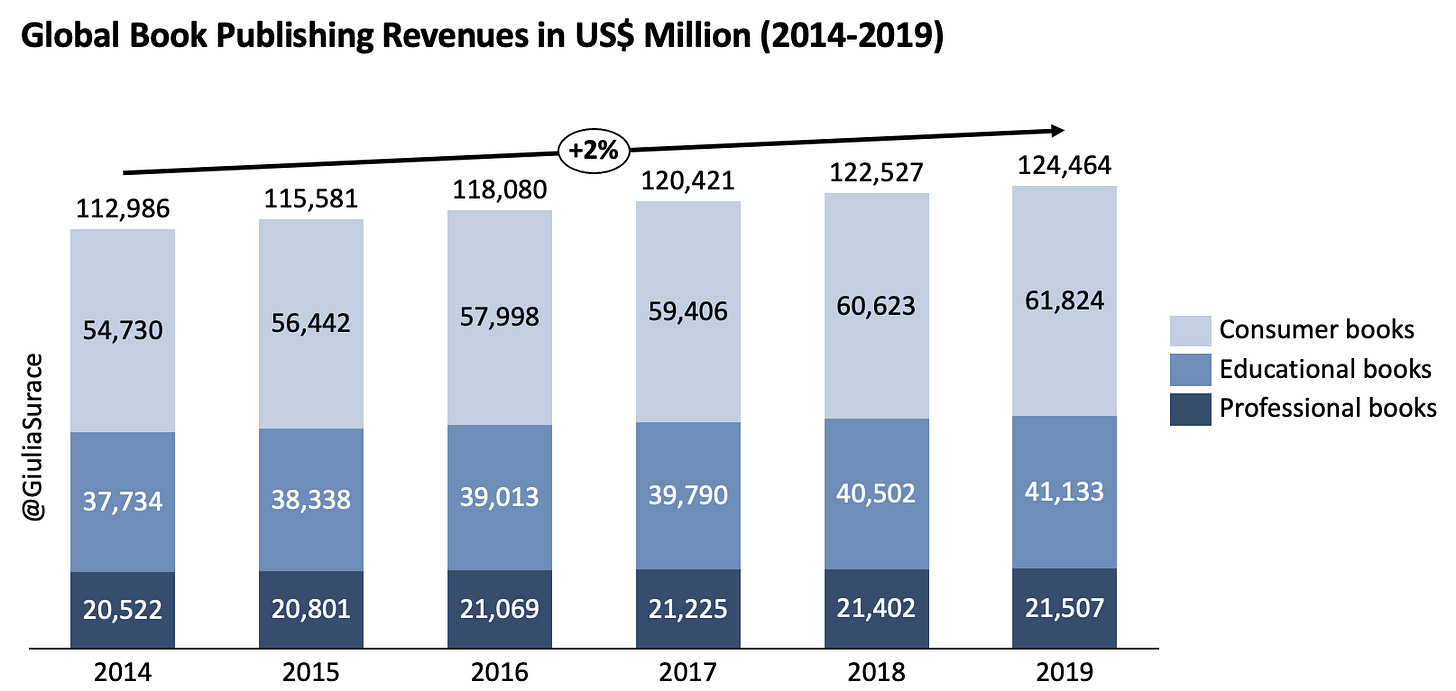

Market size figures in book publishing are notoriously unreliable due to the fragmented nature of the market and the several sources of data, with numbers sometimes varying enormously. Furthermore, some data includes academic publishing while some only refers to consumer (trade) publishing. If we add the growing self-publishing arena to the mix, the picture gets even messier. But let’s try to depict an overview:

Global book publishing revenues (2019): US$124B

Consumer books: $62B

Educational books: $41B

Professional books: $21B

Source: PWC (Global Entertainment and Media Outlook 2019 – 2023)

When it comes to estimating figures for the ebook market, we have various hypotheses. In August 2019, the American Association of Publishers, which represents mostly traditional book publishers, reported that, among their members, ebook sales accounted for 14.3% of sales revenue. However, according to a report written by Amy Watson that pulls together various sources, the actual proportion should be closer to 19%. In the UK, The Bookseller estimates the same proportion for revenues, and 36% by unit sales (number of books sold), a figure driven by the number of backlist (titles that have been out in the market for longer than a year) ebooks offered by publishers for free or under $1.00. These numbers don’t take into account independent publishing, such as self-published authors on Amazon, one of the fastest-growing segments within publishing. To give you an idea, in 2019, authors earned more than $300 million from the Kindle Direct Publishing (KDP) Select Global Fund, totalling more than $1.1 billion since the launch of Kindle Unlimited, Amazon’s unlimited subscription reading service. Because self-published authors don’t just sell through KDP, it’s hard to estimate the actual value of self-publishing and, as a whole, of the ebook market.

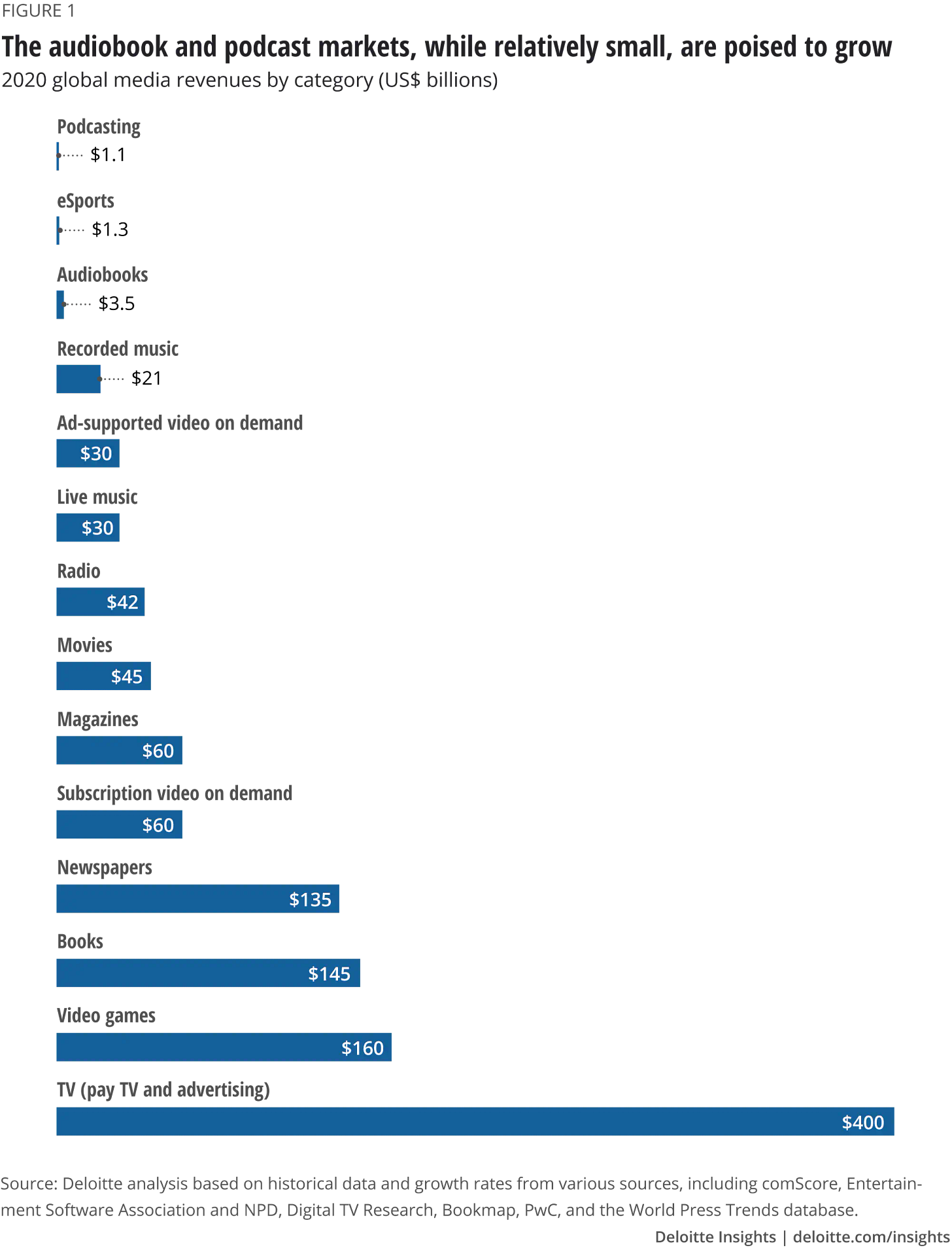

What about audiobooks? Again, we have the same issues in estimating the actual figure, but Deloitte tells us it stands at $3.5 billion. Audio has been the publishing success story for at least four years, with double-digit growth YoY and publishers increasingly focusing resources on audiobook production.

This is not really a surprise: just as the popularity of podcasting in recent years has been stemming from surging availability of high-quality content and the ease of listening to them everywhere and anytime thanks to smartphones, audiobooks have also been in demand owing to the same reasons. And to a growing acceptance that non-music audio can be a highly engaging and practical form of entertainment.

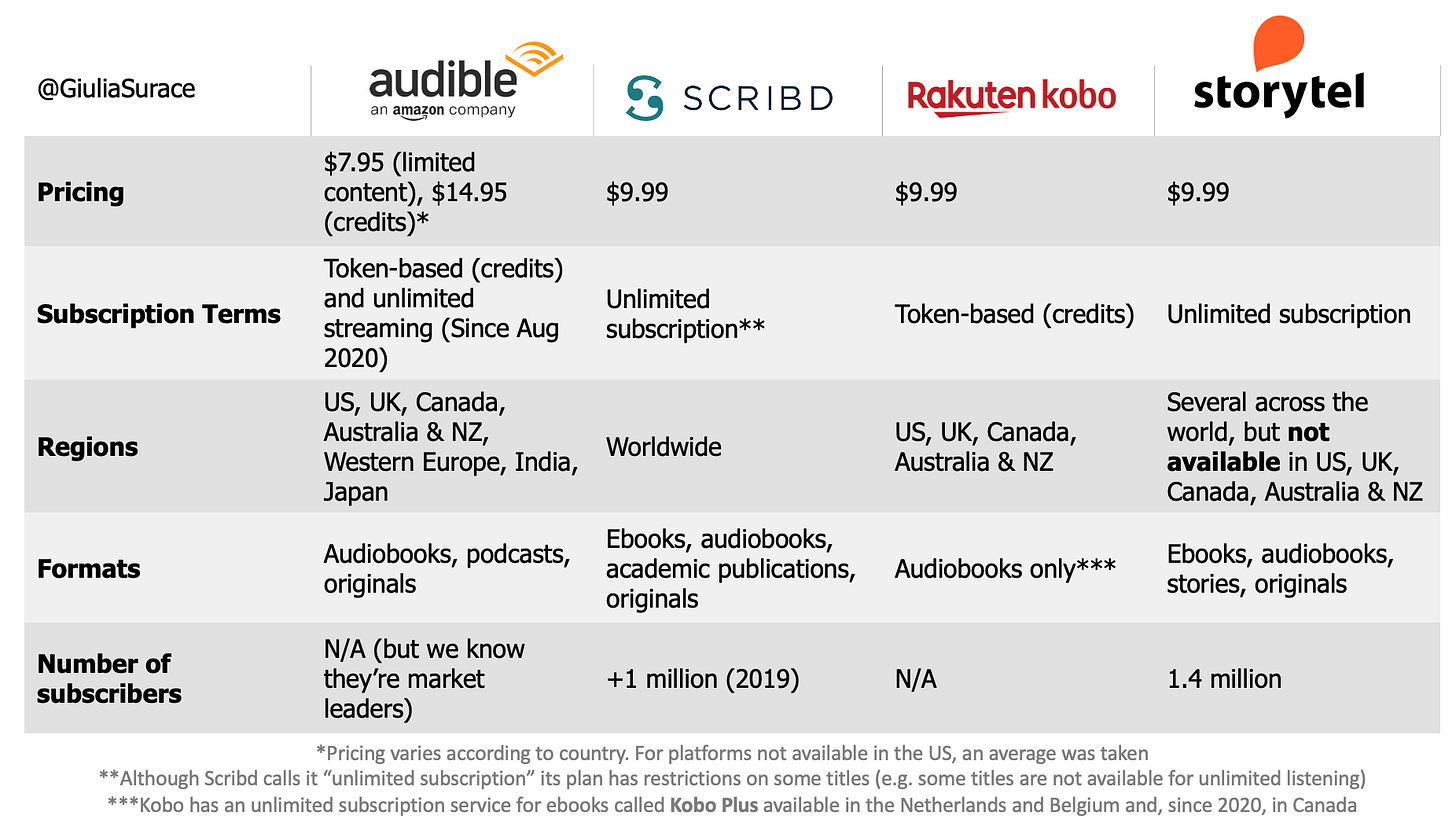

Unlike podcasts - which have multiple revenue streams in the form of advertising, sponsorships, content marketing, branded podcasts, subscriptions, donations and more - audiobooks have two basic pricing models: “a-la-carte” purchase and subscription. With the former, consumers can buy a single audiobook and own it forever. Prices range depending on whether it’s a backlist or a frontlist title. To give you an example, A Promised Land by Barack Obama is currently priced at £16.99 on Apple Books (UK). The lowest priced audiobooks I’ve seen available to be purchased “a-la-carte” are £7.99. With a subscription, people pay a monthly flat fee and can stream them with services such as Audible, Scribd and Storytel. These services differ in terms of content and format offering, territory availability and subscription terms (e.g. unlimited streaming vs. token-based).

This is by no means a comprehensive list of digital platforms offering audiobooks via subscriptions. Other than Storytel, Sweden is also home to Nextory, BookBeat (backed by publishing giant Bonnier) and Bokus Play. I also haven’t included the wider audio space in China, which deserves an article of its own.

However, it is clear that the proliferation of unlimited streaming services for audiobooks (and, to a lesser extent, ebooks) goes hand in hand with the surging popularity of video and music streaming. And while some big publishers have largely kept away or withdrawn from the unlimited streaming model, platforms have doubled down on their expansion plan – Storytel is now present in 22 markets and plans to add 18 more by 2023 – and strengthened their unlimited subscription offering. All this while increasing their own original audio productions, in a move that allows them to rely less and less on publishers’ licensed content (the Netflix move). Notably, all the platforms above are now producing their own original audiobooks (also called “audio shows”). Clearly Audible has the biggest budget to produce high-end content with the collaboration of A-list celebrities, and its recent shift from offering a token-based subscription only to launching the “all-you-can-listen” service Audible Plus is another sign of audiobook platforms moving away from the restricted space of publishing to go towards the wider entertainment audio territory to compete with the likes of Spotify. Entering Spain for the first time in October 2020, Audible launched with its unlimited plan directly, after having trialled it in Italy. And this decision has significant implications for publishers as well:

Audible’s decision to use an unlimited model in Spain, Celaya says, “implies that Audible won’t be able to offer Penguin Random House titles to their unlimited customers, since PRH decided earlier this year to withdraw all its ebooks and audiobooks from streaming subscription platforms worldwide,” including Bookbeat, Beek, Scribd, Storytel, Nextory, and Ubook.”

The Impact of the Pandemic 🦠

Did Audible always plan to move towards an “all-you-can-listen” model? Probably. Did the COVID-19 pandemic accelerate this move? Potentially. We can only speculate, but something we know for sure is that Amazon claims to be earth’s most customer-centric company. What do consumers want? Unlimited access to content. It was only a matter of time before Audible went this direction. And not only because that’s what customers are asking for, but also to consolidate their entertainment offering. With this, Audible looks more and more like Prime Video or Amazon Music.

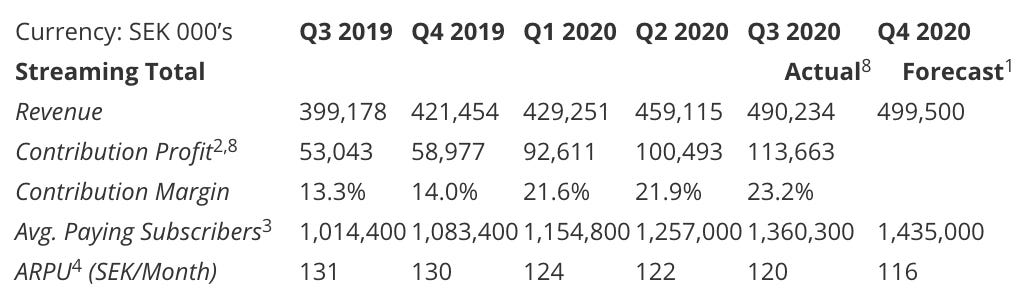

What about Storytel? Let’s look at their quarterly report numbers (Q3):

For a breakdown between Nordics and Rest of the World, you can find the report here.

Storytel had an average of 1.36 million paying subscribers in Q3, up 103,300 on Q2 2020. Annual subscriber growth in Q3 was 345,900 over 2019. Q3 streaming revenues hit SEK 490.2 million ($55.5 million), +23% YOY. ARPU has been going down but that shouldn’t be cause for concern: Storytel is experiencing growth from markets where it charges less per month for its service compared to Scandinavian countries, where it charges more per month. As a result, the average price paid is going down. While ARPU is generally lower in these markets, royalties can also be lower in those regions as well, as users stream more local market content or original content produced by Storytel. Therefore, they are able to maintain and even grow their contribution margin.

And Storytel is not the only player seeing its numbers soar: fellow Nordic platforms BookBeat and Nextory have also been enjoying growing popularity. The former saw Q3 revenues up 69%, on target to reach $57 million and over 400,000 subscribers by the end of 2020; the latter grew Q3 revenues by 76% and announced having raised SEK 165 million ($20 million) in November 2020, which will be used to scale up their global expansion.

Initially, audio consumption seemed to have been negatively affected during the pandemic. After all, several people listen to podcasts and audiobooks while commuting, running and sometimes in conjunction with other manual activities (e.g. cooking). Yet, not only did numbers not decline, they smashed the forecasts. And if this was the trend across the Nordics, chances are that platforms like Audible and Scribd are also seeing comparable, if not higher, levels of growth.

Libraries and publishers reported a surge in new interest for ebooks as well during the pandemic:

For example, at OverDrive, which helps 90% of libraries in North America offer ebooks to their patrons, ebook loans have jumped 53% on average since before mid-March. Young adult nonfiction ebook checkouts are up 122%, and juvenile fiction is up 93%. […] The system has also seen 343,000 people create new digital library cards since the beginning of March, more than double the number created in all of last year.

Significantly, sales of ebooks, though increasing, didn’t grow as much, as publishers kept prices relatively high, prompting readers to rely more on libraries.

Final Thoughts: the Future of Ebook and Audiobook Subscriptions 🧱

Contrary to popular belief, print books sales are growing every year. And despite much of the retail world is facing a crisis that is being further accelerated by the pandemic, book publishing is set to keep growing, with 2020 positioned to be one of its strongest years yet. However, as books remain one of the most loved cultural products across the world, traditional (i.e. not self-published) ebooks and audiobooks risk being left behind due to conservative pricing models that struggle to find their place in a media space dominated by unlimited access to content memberships. As Jonas Tellander, CEO of Storytel, put it:

The book market, to stay relevant, as it’s always done over time, really needs to embrace the unlimited subscription model. Then it’s all a question of how strong we are as a book industry to hold our ground and ensure that the story creation can remain within the book publishing ecosystem and reach customers in a way that is profitable for the authors and good for the customers.

As content producers, authors are at the centre of the whole process. If the system cannot be sustainable for authors, then sooner or later it will break down. But in an age that provides a lot of entertainment choice, sticking with a consumer model rather than being flexible and moving with the market can be detrimental for customers, authors and publishers alike.

P.S. If you’re interested in the debate about digital publishing and streaming, I recommend The New Publishing Standard by Mark Williams, an essential source for digital publishing news!

Thanks for reading! Subscribe here to receive this newsletter in your inbox each week: